A decent income

Many of our clients are on low incomes, and most experience financial stress. In 2017-18, we enhanced our efforts to help people increase their income through work and to manage their money.

Our financial capability and counselling services worked with 1,483 people in financial distress in 2017-18. This includes our financial counsellors, Money Smart financial capability workers and our AGL-funded adviser as well as a new financial counsellor funded by the Queensland Government to support Scenic Rim residents affected by Tropical Cyclone Debbie.

Our efforts to back vulnerable people to gain paid work included:

- ParentsNext encouraged almost 500 parents to set work-related goals and take steps to achieve them – 59 parents gained jobs in the year

- we trialled an employment engagement worker for six months to link clients of our case management teams with jobs – we found jobs for 26 disadvantaged jobseekers and linked others with specialised supports and training

- 41 people moved into paid work after volunteering at Substation33

- our RailTrail and Community Campaigns traineeships programs offered paid on-the-job training opportunities to 24 people, with 15 moving to ongoing roles after their traineeships finished

- we kicked off our Spark project for public housing tenants, highlighted in the previous section of this report.

We were very grateful to Maurice Blackburn Lawyers for a $10,000 donation earmarked for employment-related expenses. These funds have allowed us to help trainees buy work clothing and Spark clients to pay for training they needed to get work.

One of the barriers to work for some people is substance use, in an environment with increasing use of drug testing in workplaces. YFS undertook a small research project in 2017-18, in conjunction with the Alcohol and Drug Foundation to explore ways to reduce harm to young jobseekers from alcohol and drug use. Consultation with young people and stakeholders indicated that activities are more effective than education. The research identified Substation33 as an engaging alternative to drug use for young people, and outlined the potential to make this more purposeful through mentoring.

Looking forward in 2018-19

Innovation and inspiration

In August 2017, YFS launched a marketing campaign to reduce the take-up of consumer leases. Leasing furniture and appliances at exorbitant costs is a common issue for clients who seek help from YFS. We worked with advertising agency Rumble to create marketing materials that conveyed the true cost of rent-to-buy arrangements.

Throughout the three-month period, the Done With Debt campaign reached more than 40,000 people through social media, mainstream media and in-person contact by a team of peer educators. The campaign generated referrals for financial counselling and budgeting, and increased awareness of No Interest Loan Scheme (NILS) loans as an alternative. Our www.donewithdebt.com.au website continues to provide simple information about alternative ways for people to get the products they need without going into debt.

Outcomes

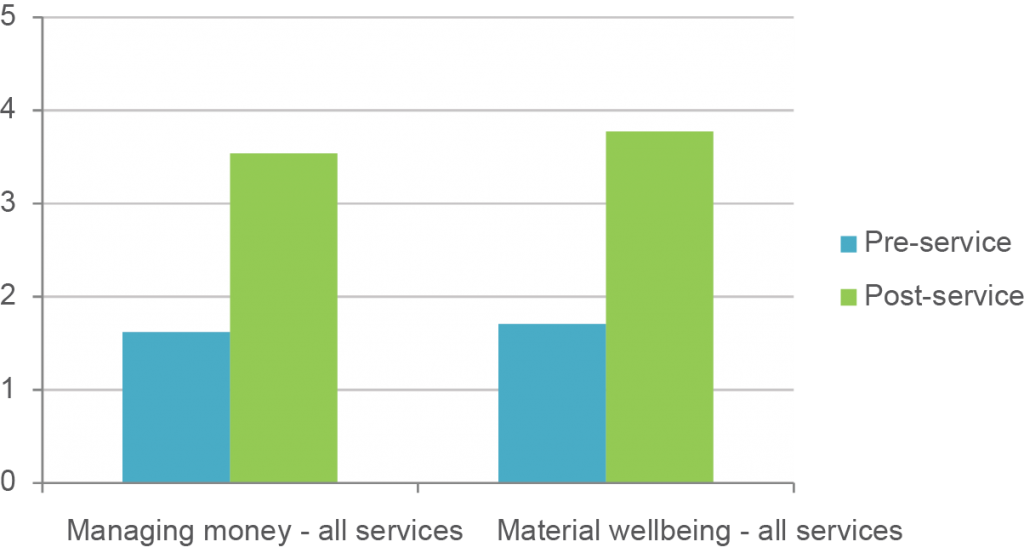

Our services that receive funding from the Federal Department of Social Services track improvement in client’s circumstances and achievements. That’s how we know our services helped people improve their ability to manage money and their material wellbeing, particularly our financial counselling and capability services.

Our organisational outcomes survey tracks changes in our clients’ financial security across all YFS programs. More than half of our clients are in financial stress when they engage with us. We improved our focus on this issue in 2017-18, with 24% of clients improving their ability to pay their bills, compared with 17% the previous year.

Financial wellbeing 2017-18

Paige's story

“When I told Rachel I got a job, I could see she was so excited for me. That made me feel proud of what I had achieved and gave me the desire to think about what’s next for me. I can never forget the first time I met Rachel.”